Accessing quality dental care shouldn’t be a financial burden. In Singapore, various schemes like the Community Health Assist Scheme (CHAS), Medisave, and private insurance plans work together to make dental treatments more affordable for residents. Understanding how these options function can empower you to make informed decisions about your oral health without breaking the bank.

Medisave is a national savings scheme that allows Singaporeans to set aside part of their income for medical expenses. While primarily aimed at hospitalizations and major surgeries, Medisave can also be utilized for certain outpatient dental procedures.

What Are CHAS Subsidies?

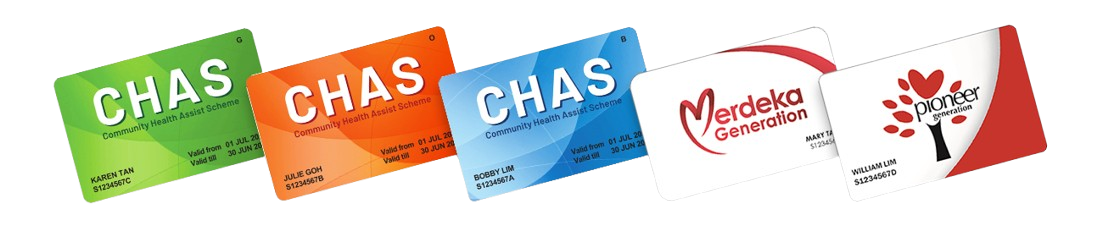

The Community Health Assist Scheme (CHAS) is a government initiative designed to provide financial assistance for medical and dental care to Singaporean citizens, particularly those from lower- to middle-income households.Who Is Eligible?

CHAS is available for Singaporeans aged 60 and above, as well as those with chronic conditions or disabilities. Eligibility is determined based on household income and the number of dependents. The scheme offers different tiers of subsidies:- Blue Card Holders: For lower-income families, providing higher subsidies.

- Orange Card Holders: For middle-income families, offering slightly lower subsidies.

What Services Are Covered?

CHAS subsidies can be used for a range of dental services, including:- Routine check-ups

- Fillings

- Extractions

- Scaling and polishing

Understanding Medisave

Understanding Medisave

Medisave is a national savings scheme that allows Singaporeans to set aside part of their income for medical expenses. While primarily aimed at hospitalizations and major surgeries, Medisave can also be utilized for certain outpatient dental procedures.What Dental Procedures Can You Claim?

Under Medisave, you can use your savings for specific dental treatments such as:- Surgical extraction of teeth

- Dental implants

- Periodontal surgery

How to Make a Medisave Claim

- Consult Your Dentist: Discuss the procedure you need and confirm if it’s eligible for Medisave claims.

- Complete the Necessary Forms: Your dentist will assist you in filling out the required forms.

- Submit Your Claim: Claims are usually submitted electronically through your dentist’s clinic.

Navigating Private Insurance Plans

In addition to CHAS and Medisave, many Singaporeans opt for private health insurance to cover dental expenses. Understanding your insurance policy can help you maximize benefits while minimizing out-of-pocket costs.Types of Dental Insurance Coverage

Private insurance plans may offer varying levels of coverage:- Basic Plans: Often cover routine check-ups and preventive care.

- Comprehensive Plans: Provide broader coverage, including major procedures like crowns, bridges, and orthodontics.

Key Considerations When Choosing Insurance

- Coverage Limits: Check the annual limits on how much can be claimed for dental treatments.

- Waiting Periods: Some plans may have waiting periods before coverage kicks in for specific treatments.

- Network Dentists: Ensure that your preferred dental clinic is within the insurer’s network to maximize benefits.